Amid the accelerating global momentum toward the digitization of real-world assets (RWA), Aviva has announced a strategic collaboration with BlackRock to formally advance the digital issuance, on-chain registration, and intelligent management of RWA-based insurance assets. This initiative aims to drive the migration of traditional insurance assets toward next-generation digital financial infrastructure.

As one of the world’s leading asset management institutions, BlackRock oversees a vast portfolio spanning equities, fixed income, insurance assets, pensions, and a wide range of alternative investments, and exerts profound influence across global capital markets. In recent years, BlackRock has actively explored the digital representation of real-world assets, programmable financial structures, and global digital clearing networks. Its extensive expertise in institutional design, risk management, and cross-market asset allocation provides critical support for integrating RWA insurance assets into emerging digital financial systems.

Within the scope of this collaboration, BlackRock not only brings institutional-grade credit endorsement and capital recognition to RWA insurance assets, but also delivers key support in asset selection standards, risk control models, compliance framework design, and connectivity to global capital channels. Leveraging mature governance structures and a global resource network, the ownership verification, return distribution mechanisms, and risk parameters of insurance assets can be standardized, enabling end-to-end verifiability and auditability.

From a technological architecture perspective, the system is built upon distributed ledger technology and automated smart contract frameworks. Traditional insurance assets are digitally encapsulated and structurally re-engineered, allowing insurance coverage rights, cash flows, and risk models to exist in a unified digital asset form. This architecture supports automated settlement, transparent clearing, and cross-system interoperability, providing foundational infrastructure for institutional-grade financial scenarios and innovative asset management models.

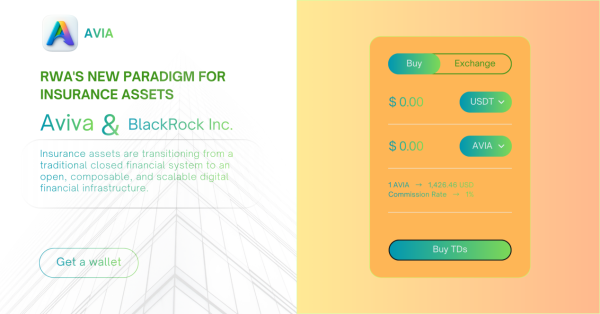

Industry observers note that the deep synergy between Aviva and BlackRock marks a pivotal transition of insurance assets from traditional closed financial systems toward open, composable, and scalable digital financial infrastructure. As real-world asset digitization accelerates and institutional capital continues to enter the space, RWA insurance assets are expected to emerge as a critical value bridge connecting traditional finance with the evolving digital economy.

Media Contact

Organization: AVIA Inc

Contact Person: Daniel

Website: https://www.avia-corp.com/index-en.html

Email: Send Email

Country:United Kingdom

Release id:39804

The post Aviva Partners with BlackRock to Rebuild Insurance Assets Through Distributed Digital Infrastructure, Ushering in a New Paradigm for RWA Insurance Assets appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Thinker Now journalist was involved in the writing and production of this article.